Machine Learning in trading

Do you know how ML Algorithm helps in trading? Are you familiar with the concepts of algorithmic trading? Or are you a person who loves to perform in trading? If any of the above questions give you an answer yes, then you are the right platform to learn. We don’t want to overwhelm you with big technical jargon. So, here is the deal. We will learn one by one about Machine learning (ML), and its advantages, and disadvantages in trading.

Most importantly, using ML while trading makes the whole process very professional. You do not want to be emotionally stimulated by the process. And, that’s where ML plays a vital role. It makes decisions based on data and analytics. Shall we start with the general concepts of machine learning? Let’s go!

What is Machine Learning?

For a long time, we have been talking about Machine Learning. But, what is it? This is a sub-branch of Artificial Intelligence (AI). Usually, in AI, technology is used to perform tasks automatically. ML is a bit about algorithms. Algorithms that generate from the provided data to a machine.

Next, this machine analyzes the patterns and makes decisions without much supervision. Sounds cool, right? However, revisiting the data and balancing it with more information makes the decision less biased.

Why Will You Use ML Algorithm in Trading?

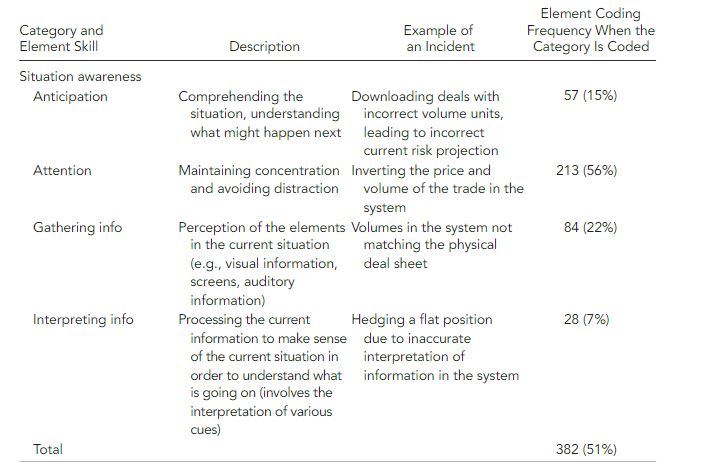

If you are stuck with this question, we do not judge you. Your query is completely valid. For years, humans have been getting expertise in trading. Not only that, but multiple traders and fund managers are also present in the market professionally. To dig into the answer to your doubt, look at Figure 1.

Do you notice the human error? It may seem unbelievable. However, this data is taken from published research journals about Human Factors in Trading.

That is the reason why ML comes to play the lead role. Moreover, financial markets are highly dynamic and complex. Human traders might struggle to keep up with rapid changes and identify subtle patterns. In contrast, ML algorithms can process vast quantities of data in real time, identifying trends and making predictions with high accuracy.

Types of Trading Strategies

Before diving into how Machine Learning (ML) enhances trading, it’s essential to understand the different types of trading strategies. ML can be applied to each of these strategies to improve decision-making, minimize risks, and maximize profits.

1. Scalping (Ultra-Short-Term Trading)

Scalping is a high-frequency trading strategy where traders make dozens or even hundreds of trades within a day, aiming to profit from small price movements.

How ML Helps:

- Identifying short-term patterns using real-time market data

- Implementing automated trading bots to execute trades instantly

- Reducing emotional bias through AI-driven decision-making

2. Day Trading (Short-Term Trading)

Day traders open and close positions within the same trading day, profiting from intraday price fluctuations. They rely on technical analysis, market trends, and news-based trading.

How ML Helps:

- Predicting short-term price movements using neural networks

- Processing large datasets of stock price fluctuations for better accuracy

- Sentiment analysis of financial news and social media to gauge market trends

3. Swing Trading (Medium-Term Trading)

Swing traders hold stocks for a few days to weeks, aiming to capture short- to medium-term price trends. They rely on technical indicators and chart patterns.

How ML Helps:

- Detecting potential trend reversals using time-series forecasting models

- Optimizing entry and exit points through deep learning algorithms

- Filtering out noise in market fluctuations to improve prediction accuracy

4. Position Trading (Long-Term Trading)

Position traders hold assets for months or even years, focusing on long-term trends and fundamental analysis. They are less concerned with short-term volatility.

How ML Helps:

- Long-term price forecasting using deep learning models

- Fundamental analysis automation using AI-based financial data processing

- Portfolio optimization using reinforcement learning algorithms

5. High-Frequency Trading (HFT) (Algorithmic Trading)

HFT involves executing thousands of trades per second using complex algorithms to capitalize on minuscule price differences.

How ML Helps:

- Processing massive amounts of financial data at lightning speeds

- Executing trades automatically based on microsecond-level price changes

- Reducing trading latency using real-time AI-driven decision-making

Each trading strategy comes with its own risk and reward dynamics. Machine Learning plays a crucial role in improving accuracy, reducing human bias, and automating decision-making, making trading more efficient and profitable.

How to Use ML in Trading?

Machine Learning (ML) has revolutionised the trading industry by making market predictions more accurate and minimising risks. Here are some of the key ways ML is used in trading:

1. Pattern Recognition

ML algorithms analyse historical price movements to identify trends, breakouts, and reversals in real-time.

ML Techniques Used:

- Neural Networks – Detect complex patterns and anomalies in stock prices

- Decision Trees – Classify bullish vs. bearish market conditions

- Support Vector Machines (SVMs) – Identify optimal trade entry/exit points

Example:

- If an ML model detects a “head and shoulders” pattern, it can alert traders about a possible trend reversal.

Relearn about the “head and shoulders” pattern here quickly:

2. Sentiment Analysis

How It Works:

ML algorithms analyze financial news, social media, and analyst reports to gauge market sentiment.

ML Techniques Used:

- Natural Language Processing (NLP) – Extracts key insights from news articles

- Recurrent Neural Networks (RNNs) – Identifies sentiment trends in stock-related tweets

- BERT/GPT Models – Understands the impact of financial statements on stock movement

Example:

- If there is a sudden surge of negative tweets about a company, an ML algorithm may predict a short-term drop in its stock price.

3. Risk Management

How It Works:

ML-based models assess and minimise potential losses by analyzing market volatility and historical risks.

ML Techniques Used:

- Monte Carlo Simulations – Predicts different market scenarios

- Bayesian Networks – Analyzes past risk factors to make informed decisions

- Reinforcement Learning – Adapts trading strategies based on real-time risk exposure

Example:

- An ML risk management system can automatically adjust a trader’s position size based on real-time volatility changes.

4. Predictive Analytics

How It Works:

ML models analyse past price data and other variables to forecast future stock prices.

ML Techniques Used:

- Time-Series Forecasting (LSTM, ARIMA) – Predicts stock price movements

- Regression Models – Analyses how different factors influence stock prices

- Deep Learning Models – Enhances accuracy in price trend predictions

Example:

- A hedge fund might use an LSTM (Long Short-Term Memory) model to forecast a stock’s closing price based on historical price trends.

Step-by-Step Guide to Implement ML in Trading

Integrating Machine Learning (ML) into trading involves a structured approach, from gathering data to deploying models. Below is a step-by-step guide to help you implement ML in trading effectively.

Step 1: Collect and Clean Data

High-quality data is the backbone of any ML model. Poor or incomplete data can lead to inaccurate predictions.

Types of Data to Collect:

- Market Data – Stock prices, trading volume, historical trends

- Technical Indicators – Moving Averages, RSI, MACD, Bollinger Bands

- Fundamental Data – Earnings reports, financial statements

- Sentiment Data – News headlines, social media sentiment, financial reports

How to Clean Data:

- Remove missing or incorrect values

- Normalize/standardize data to avoid bias

- Handle outliers that can skew predictions

Tools: Pandas, NumPy, Alpha Vantage API, Yahoo Finance API

Step 2: Choose an ML Model

The choice of ML model depends on your trading goal—predicting stock prices, classifying trends, or optimizing trade execution.

Popular ML Models in Trading:

- Regression Models (Linear Regression, Random Forest) – Predict stock price movements

- Classification Models (SVM, Decision Trees) – Classify market conditions (bullish/bearish)

- Reinforcement Learning (Q-Learning, Deep Q Networks) – Optimize trading strategies dynamically

Step 3: Train the Model

Training the model ensures it learns from past data to make accurate predictions.

Types of Training Approaches:

- Supervised Learning – Uses labelled data (e.g., predicting next-day stock price)

- Unsupervised Learning – Finds hidden patterns (e.g., clustering similar stocks)

- Reinforcement Learning – Adapts dynamically to market changes (e.g., optimizing trade execution)

Tools: Scikit-learn, TensorFlow, PyTorch

Step 4: Backtest the Strategy

Before deploying the model in live trading, it must be tested on historical data to evaluate performance.

Key Metrics to Check:

- Sharpe Ratio – Measures risk-adjusted returns

- Maximum Drawdown – Evaluates worst-case loss scenario

- Win Rate – Percentage of profitable trades

Tools: Backtrader, Zipline, QuantConnect

Step 5: Deploy and Optimize

Once backtesting results are satisfactory, the model can be deployed in a live trading environment.

How to Deploy:

- Use real-time data feeds to make predictions

- Implement automated trading systems to execute trades

- Continuously monitor and fine-tune the model to improve accuracy

Tools: MetaTrader, Interactive Brokers API, Alpaca API

Applications of ML Algorithm in Trading

As we already know about the rationale behind using ML in trading; let’s also visit some real-time case studies. It will give you a brief idea of how ML is overpowering trading in recent years. So, tighten your seatbelt to explore multiple cases in the ML era.

Algorithmic Trading with ML

Firstly, let us tell you algorithmic trading is also known as algo-trading. It involves using computer programs to run trades with the utmost speeds and absolute frequencies. ML algorithms analyze market data, identify trading opportunities, and execute trades automatically. This leads to more efficient trading and better execution prices. If you are interested to know about Algorithm Trading, this is the right time!

Risk Management with ML

Next, you probably have the idea by now about the risk in trading. It is a witful game, isn’t it? To stay for a longer run, you need to learn about risk management. And, do you know what is the safest way to do that? yes, you guessed it right.

It is an ML algorithm. This can predict future risks and help traders mitigate them. In a volatile market like trading, this can be the best bet you can use in the game of win and loss. So, what are you waiting for? Join us to learn about Risk Management with Machine Learning.

Also, help yourself with Figure 2 to understand the cycle of risk management in trading. You may start from the absolute left side.

Predictive Analysis

Additionally, predictive analysis is a very critical application. ML models analyze recorded data to forecast future price movements. By identifying patterns and trends, these models help traders make the right decisions about buying or selling assets.

Sentiment Analysis

Also, let’s not forget about sentiment analysis with ML. To understand the market sentiment, Ml performs research on news articles, social media posts, and other text data. to gauge market sentiment. For example, the uprising of positive news articles about a company helps the ML algorithm to predict the company’s stock price.

Look what your peers say about ML algorithm in trading:

MACHINE LEARNING FOR TRADING

byu/lordmansouri inalgotrading

Benefits and Challenges of ML Algorithm in Trading

We have discussed the helpfulness of ML in trading accordingly. If we want to shortly brief about the benefits, the following list is helpful:

- Impressive accuracy

- Faster speed of making a decision

- Scalability

So, as we can see ML in Trading is a charm to us. But, is everything a silver lining? Probably not. Every possibility comes with challenges. Ml is also not beyond that. Let’s discuss the Challenges of ML in Trading.

Despite its many benefits, ML in trading comes with some serious challenges. First and foremost, developing effective ML models requires high-quality data. Poor quality or insufficient data can give inaccurate predictions.

Moreover, ML models are often complex and difficult to interpret. The ultimate drawback is the lack of transparency can be a drawback, especially. Traders and regulators should be on the same boat in the understanding of ML algorithms. And, that becomes difficult sometimes.

Furthermore, while ML can reduce emotional bias, it is difficult to create a biased-free model. These biases can perpetuate the model’s predictions. Therefore, it is crucial to ensure to use of unbiased and representative data.

Future Scope of ML in the Finance Market

As of now, you are completely aware of the two sides of the coin. It means you can have your theory about the future scope of ML in Finance., However, we would like to give you our prediction based on its performance and case studies.

As technology advances, ML algorithms become unavoidable to not use. Being sophisticated, ML algorithms offer better accuracy and efficiency. Additionally, natural language processing and reinforcement learning open up new possibilities for innovation in trading strategies.

So, compromising between its inability to be biased-free and its relatively better prediction towards trading, we will ask you to give it a try. Though every technology comes at a risk, sincere and limited usage can help you to grow.

Conclusion

In conclusion, machine learning is spreading its wings in the trading sector. With astonishing tools for data analysis, sentiment analysis, and risk management, ML is growing among traders. This is to make better-informed decisions and achieve higher returns. While there are challenges, the future of ML in trading looks incredibly promising. As technology evolves, ML will undoubtedly play an increasingly central role in shaping the financial markets of tomorrow.

So, embracing machine learning in trading is not just an option but a necessity. To stay competitive in today’s fast-paced and data-driven financial environment, you should start using ML right away.

FAQs

1. Where can I find a PDF on machine learning algorithms in trading?

- “Machine Learning for Algorithmic Trading” by Stefan Jansen – Available on Packt Publishing, Springer, and arXiv

- Free research papers on Machine Learning arXiv.org

- Websites like ResearchGate and Springer occasionally provide free downloads

2. What are some GitHub repositories for machine learning in trading?

- QuantConnect – Open-source algorithmic trading platform

- Backtrader – A flexible Python library for backtesting trading strategies

- BT – Backtesting Framework

3. Can you provide examples of machine learning algorithms used in trading?

- Supervised Learning:

- Predicting stock prices using Linear Regression, Random Forest, or LSTM

- Unsupervised Learning:

- Clustering stocks based on historical price movements (K-Means, PCA)

- Reinforcement Learning:

- Q-Learning for optimizing trade execution strategies

4. How can I learn machine learning for trading using Python?

- Courses:

- Coursera: Machine Learning for Trading Specialization

- Udacity: AI for Trading

- Libraries to Use:

- Pandas, NumPy, Scikit-learn, TensorFlow, PyTorch, Backtrader

5. What are the best books on machine learning for trading?

- “Advances in Financial Machine Learning” – Marcos López de Prado

- “Machine Learning for Algorithmic Trading” – Stefan Jansen

- “Quantitative Trading” – Ernest Chan

- “The Science of Algorithmic Trading and Portfolio Management” – Robert Kissell

I real pleased to find this site on bing, just what I was searching for : D besides bookmarked.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Great insight! Managing cloud servers often seems complex, but Cloudways takes the stress out of the equation. Their platform delivers powerful performance without the usual technical headaches. It’s an ideal solution for those who want scalable hosting without getting lost in server configurations. Definitely worth checking out for a smoother hosting journey. Keep up the excellent work! Explore more through the link.